The laws that Congress passes relative to the federal budget, as well as the fiscal policies that motivate that legislation, can have immediate and long-term effects on the national economy. In turn, economic factors such as the gross national product, the federal deficit, the national debt, and the unemployment level will inform and limit the legislative choices that Congress makes. No one can be sure exactly what the future holds, and budgetary decisions almost always require some sort of trade-off, but a fiscally aware Congress will be in a better position to make wise choices concerning federal appropriations and expenditures.

The Congressional Budget Office

The Congressional Budget Office is a nonpartisan agency that produces objective, impartial analyses of budget-related and economic issues to guide the Congress during the budget-making process, alerting members to the impact that current and proposed legislation and policies can be expected to have. The CBO makes baseline projections of the economy under current laws and provides estimates of the likely effects of proposed changes in policy, but they stop short of making any actual recommendations.

The Budget and Economic Outlook: 2014 to 2024

This week the CBO presented their latest report on the Budget and Economic Outlook for the 10-year period used in the Congressional budget process, and they had some good news and some bad news.

The Federal Deficit

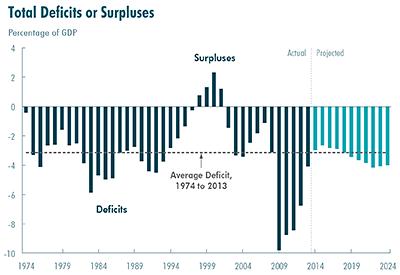

According to their report, the federal deficit is expected to shrink to $514 billion in 2014. This would be equal to 3 percent of the nation’s total economic output, or Gross Domestic Product, which is typical for the last 40 years. $514 billion sounds like a lot of money, but contrast it with the $1.4 trillion deficit the government had in 2009 and it looks pretty good. Things will look even better as the deficit continues to decline during 2015 to about $478 billion, or 2.6 percent of the GDP.

The rest of this 10-period doesn’t look so rosy, however. If current laws remain in place, federal revenues are expected to keep pace with the GDP, but expenditures will grow more rapidly as the population ages and more money is spent on Social Security, federally subsidized health care programs, and rising interest payments on the national debt.

The National Debt

The national debt is projected to reach 74 percent of the GDP by the end of the year, rising to 79 percent by the end of 2024. The CBO warns that this level of debt is “very high by historical standards.” Such an enormous national debt can put a damper on economic growth, reduce the flexibility legislators have to deal with unexpected challenges as they arise, and eventually could lead to a fiscal crisis.

Unemployment

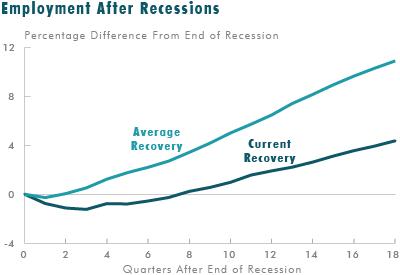

The unemployment rate is expected to drop gradually, falling below 6 percent in 2017 and dropping to 5.5 percent by the end of 2024. This is an improvement, but still disappointing compared to the rate of 4.8 percent in 2007, and is well below the average rate of recovery after a recession.

A separate CBO report issued on the same day as the budget and economic outlook discusses the reasons for the slow recovery of the labor market and makes some very tentative projections.

Insurance Coverage Provisions of the Affordable Care Act

The CBO has made updated estimates of the insurance coverage projections of the Affordable Care Act and predicts that the glitches that kept people from enrolling in the exchanges for the first few months of the exchange period will cause total enrollment to fall below what was estimated earlier, but not by much, and last-minute enrollment by people wishing to avoid a penalty could still bring the enrollment close to the original prediction (or maybe not—they’re very noncommittal), and within the next couple of years enrollment is expected to rise sharply as people become more familiar with their options.

The Risk Corridor Program, which reduces the amount of financial risk to insurers that sell plans in the first years of the exchanges, is expected to bring in a net surplus to the Treasury of $8 billion by the end of 2017. This is considerably better news than the CBO’s earlier prediction that the Risk Corridor Program would just break even.

Premiums for insurance policies bought through the exchanges are also expected to cost about 15 percent less than previously anticipated.

Labor Market Effects of the Affordable Care Act

The CBO has revised its earlier estimates of the labor market effects of the Affordable Care Act, but warns that its estimate is “subject to substantial uncertainty” because of a lack of information to base its projections on.

Several features of the ACA, however, are expected to result in workers voluntarily reducing their hours or leaving the labor force entirely. For instance:

- Some workers will retire earlier because they don’t need to work to keep their health insurance.

- Some people may choose to work part-time, knowing that they now have the freedom to do so without losing their health insurance.

- Some currently unemployed or low-wage workers may be actually be discouraged from working when they find out that their federal health insurance subsidies drop and their net taxes increase as their income rises.

The CBO predicts that total employment and compensation will increase over the next ten years, but that increase will be about 1.5 percent smaller by the end of 2017, and 2 percent smaller by the end of 2014, than it would have been in the absence of the Affordable Care Act. This projected reduction in employment will result primarily from workers voluntarily choosing to reduce their hours or withdraw from the labor force, not from a rise in unemployment or unemployment.

Would You Like to Know More?

Douglas Elmendorf, Director of the CBO, gave testimony before the House Budget Committee on the budget and economic outlook, summarizing and clarifying the findings for Congress.

This report and related data, reports, and other materials are available on the CBO Web site.

All CBO products except for informal cost estimates for legislation being developed privately by members of Congress or their staffs are available to the Congress and the public on the CBO Web site.

Article by Bobby Griffith.